Prepare journal entries to record the following transactions, a fundamental accounting task, provides the foundation for accurate and reliable financial reporting. This comprehensive guide will delve into the intricacies of journal entry preparation, empowering you with the knowledge and skills to effectively capture and record business transactions.

Journal entries serve as the building blocks of the accounting process, providing a chronological record of all financial transactions. They are essential for maintaining the integrity of financial statements and ensuring compliance with accounting standards.

Prepare Journal Entries to Record Transactions: Prepare Journal Entries To Record The Following Transactions

Identifying the Transactions

To prepare accurate journal entries, it is crucial to first identify the transactions that have occurred. Transactions represent economic events that affect the financial position of a company. These events can include purchases, sales, payments, receipts, and other financial activities.

When identifying transactions, it is important to consider their nature and impact on the financial statements. Transactions can be classified into different types, such as:

- Assets: Transactions that increase or decrease the company’s assets, such as purchases of inventory or equipment.

- Liabilities: Transactions that increase or decrease the company’s liabilities, such as loans or accounts payable.

- Equity: Transactions that affect the owner’s equity, such as investments or dividends.

- Revenue: Transactions that generate income for the company, such as sales of products or services.

- Expense: Transactions that result in expenses for the company, such as salaries or rent.

Journal Entry Structure

Once the transactions have been identified, they can be recorded in journal entries. Journal entries are chronological records of financial transactions. They are used to provide a detailed record of the transactions and to ensure that the debits and credits are equal.

Journal entries typically consist of the following columns:

| Date | Account | Debit | Credit |

|---|

- Date: The date the transaction occurred.

- Account: The account affected by the transaction.

- Debit: The amount debited to the account.

- Credit: The amount credited to the account.

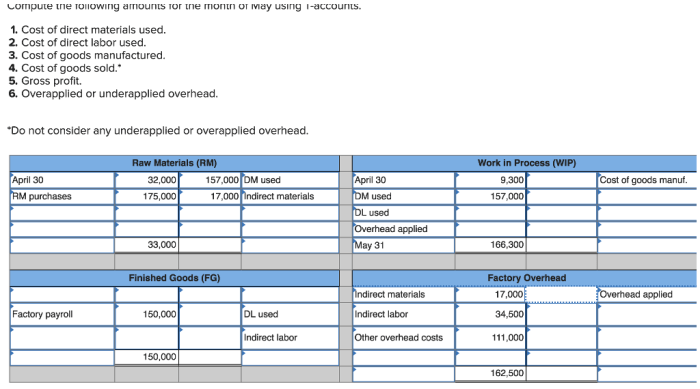

Posting to Accounts, Prepare journal entries to record the following transactions

After the journal entries have been recorded, they must be posted to the appropriate ledger accounts. Posting involves transferring the information from the journal entries to the individual accounts in the ledger. This process allows for a more detailed and organized record of the transactions.

To post a journal entry, the following steps are typically followed:

- Determine the accounts affected by the transaction: Identify the accounts that are debited and credited in the journal entry.

- Locate the ledger accounts: Find the ledger accounts for the accounts affected by the transaction.

- Enter the transaction information: Enter the date, debit amount, and credit amount in the appropriate ledger accounts.

- Balance the accounts: Ensure that the debits and credits in the ledger accounts are equal.

Examples and Illustrations

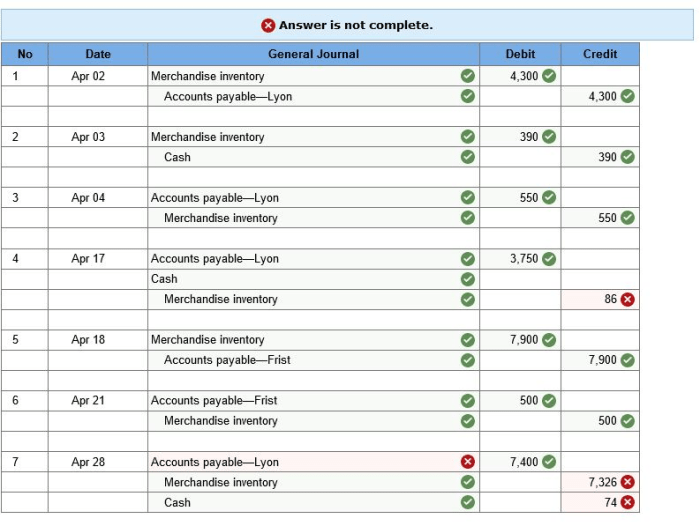

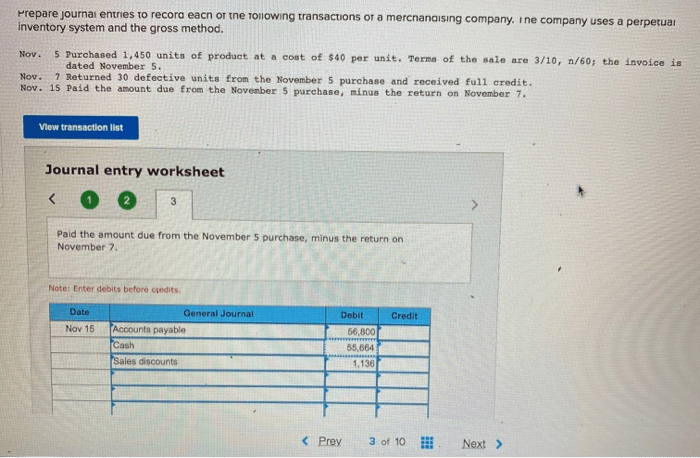

The following table provides several example transactions and their corresponding journal entries:

| Transaction | Journal Entry |

|---|---|

| Purchased inventory on account for $1,000 | Debit: Inventory $1,000Credit: Accounts Payable $1,000 |

| Sold products for cash for $500 | Debit: Cash $500Credit: Sales Revenue $500 |

| Paid salaries expense in cash for $200 | Debit: Salaries Expense $200Credit: Cash $200 |

Considerations and Best Practices

When preparing journal entries, it is important to consider the following best practices:

- Use supporting documentation: Keep invoices, receipts, and other supporting documentation to verify the accuracy of the transactions.

- Record transactions promptly: Record transactions in a timely manner to ensure the accuracy of the financial records.

- Maintain accurate and up-to-date records: Ensure that the journal entries and ledger accounts are accurate and up-to-date to provide a reliable record of the company’s financial position.

Question Bank

What is the purpose of a journal entry?

A journal entry is a record of a financial transaction that affects the accounting equation (Assets = Liabilities + Equity). It provides a chronological record of all business transactions, allowing accountants to track and summarize financial activity.

What are the essential elements of a journal entry?

A journal entry typically includes the date of the transaction, a brief description of the transaction, the accounts affected, and the debit and credit amounts.

Why is accuracy in journal entry preparation important?

Accurate journal entries are crucial for maintaining the integrity of financial statements. Errors in journal entries can lead to incorrect balances, misstated financial performance, and difficulty in reconciling accounts.